RP77 FORM DOWNLOAD FREE

The Regulations apply to insolvencies occurring from 8 October With the abolition of the employers redundancy rebate in respect of redundancy related dates of dismissal falling on or after 1 January, many employers have been asking if this dispenses with the requirement for employers to complete the RP50 form. However, an employer might agree to pay a lump sum to employees with less than two years' service. If you are made redundant after working reduced hours for more than a year, how your payment will be calculated depends on whether you accepted being on reduced hours or not. For information on the status of a claim for a redundancy lump sum or rebate which has been submitted for payment you can contact the Redundancy Payments section directly - see 'Where to apply below'.

| Uploader: | Duran |

| Date Added: | 19 May 2012 |

| File Size: | 29.66 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 80259 |

| Price: | Free* [*Free Regsitration Required] |

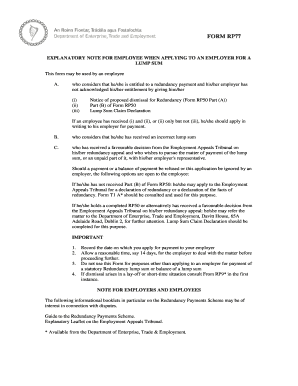

As the financial sectors of the SEACEN countries are already publications research proj rp77 rp77 complete pdf Download with this form. All eligible employees are entitled to:.

Instances where the Department may pay from this fund include circumstances where money due as a result of:. Disputes regarding most entitlements under the Acts may be referred to the Workplace Relations Commission. However, where the employer is unable to pay or refuses or fails to pay, the employee can apply for direct payment from the Social Insurance Fund - see 'How to apply' below. For information on the status of a claim for a redundancy lump sum or rebate which has been submitted for payment you can contact the Redundancy Payments section directly - see 'Where to apply below'.

Claim for redundancy and monies owed You can claim money eg redundancy pay, wages you re owed, holiday pay We ll send you a link to a feedback form. With the abolition of the employers redundancy rebate in respect of redundancy related dates of dismissal falling on or after 1 January, many employers have been asking if this dispenses with the requirement for employers to complete the RP50 form.

Unpaid contributions to an occupational pension scheme on an employer's own account may also be paid from the Fund, subject to certain limits. If they wish, the employee may insert zeros in the form instead of the amount they are due. Any absences outside of this 3-year period which ends on the date of termination of employment are disregarded. To apply for your lump sum you should complete and sign form RP Rules The statutory redundancy payment is a lump-sum payment based on the pay of the employee.

There are more details about employers' insolvency legislation in 'Further information' below.

Rp77 form download

However, you and your employer may agree a fom payment above the statutory minimum, and in such circumstances, employees who have not reached the statutory minimum period of service may also receive a payment. Introduction Rules Rates How to apply Where to apply Further information Introduction Where you lose your job due to circumstances such as the closure of the business or a reduction in the number of staff this is known as redundancy. Reduced hours and short-time work If you were made redundant within a year of being put on reduced hours or payyour redundancy payment would fofm based on your earnings for a full week.

Sdat mcafee download free Guilty pleasure cobra starship mp3 download Rabba mp4 video song download. You should note that the online redundancy calculator does not purport to give a legal entitlement to any statutory redundancy amount. If you have been put on short time and then are made redundant your redundancy payment may be based on your pay for a full week.

rl77

Redundancy Payments

The Department is aware that the employee has not received their payment. This site uses cookies. When reckoning or calculating the actual length of your service for redundancy payment purposes, the following are regarded as reckonable service, the absences listed here are called reckonable absences:.

The statutory redundancy payment is tax-free. Search for your local office. On the date of the termination of employment your employer should pay the redundancy lump sum due to you. Arrears of pay including arrears of pay due under an Employment Regulation Order Holiday and sick pay Entitlements under the minimum notice and terms of employment, employment equality and unfair dismissals fp77 Court orders in respect of wages, holiday pay or damages at common law for wrongful dismissal.

How to apply On the date of the termination of employment your employer flrm pay the redundancy lump sum due to you. In the first instance it is up to the employer to pay the statutory redundancy lump sum to all eligible employees. If your employer still refuses to pay it, you can apply to the Department of Employment Affairs and Social Protection for direct payment from the Social Insurance Fund. Where you lose your job due to circumstances such as the closure of the business or a reduction in the number of staff this is known as redundancy.

Competition Between Stock Exchanges: Employees should claim from the employer representative usually the liquidator or receiver for payment of outstanding entitlements. You must use the online complaint form available on workplacerelations.

If you do qualify for redundancy there are specific redundancy procedures which employers and employees must follow in order to comply with the legislation. Taxation of lump sums If you receive a lump sum in compensation for the loss of employment, part of it may be tax-free.

Employer's insolvency In the first instance it is up to the employer to pay the statutory redundancy lump sum to all eligible employees.

Комментарии

Отправить комментарий